The Havoc COVID-19 Is Wreaking on the Stock Market

March 23, 2020

The foundation of the stock market is confidence. This confidence allows individuals and companies alike to put their faith, along with their money, into a business they believe will perform well. If a company ends up succeeding, the investor reaps the rewards. If a company’s value drops, then the investor is susceptible to financial loss.

The recent pandemic of COVID-19 (commonly known as the coronavirus) is prompting a worldwide panic. This uncertainty manifests itself in fears about the safety of travel, congregating in schools and public spaces, and has even created fear about basic greetings like handshakes. The abrupt alarm around the disease has caused investors to suddenly sell their stocks out of doubt about their continued value—creating the biggest financial crisis in the stock market in over a decade.

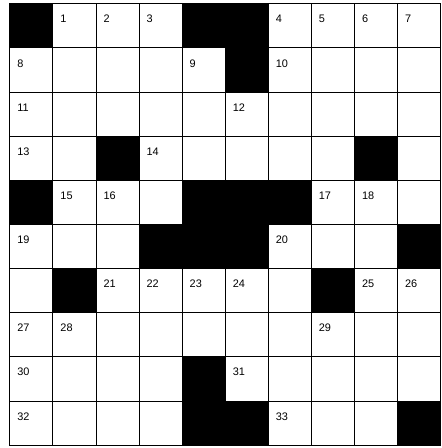

Investors are inadvertently creating a significant drop in the global stock market. The scale that monitors the stock market, the S&P index, dropped 12% in two weeks after February 19th, which accounts for the loss of approximately 3 trillion dollars globally. The scale that measures the stocks of larger companies, the Dow Jones index, decreased by over 7% during that same period, which resulted in a temporary halt to all stock trading. Mr. Benjamin Cohen, a CRLS history teacher, identified the role he sees class playing in reactions to the market drop: “The stock market is impacting the 1%, which is causing a freakout, but the economic effects towards the middle and lower class were pre-existing.” George Brown ’22 explained further: “The crash of the stock market is the only effective method to make complacent conservatives act on lower-class issues.” These sentiments are an example of the way stock market crashes affect not only the economy but the country’s political climate.

The abrupt alarm around the disease has caused investors to suddenly sell their stocks out of doubt about their continued value.

In addition to the individual investors’ choice to sell stocks, many Chinese companies are unable to run because of the American travel ban on Chinese citizens and goods. A commonly known fact is that the majority of the United States’ manufactured goods are made in China or with Chinese parts. With the travel ban, these essential products are unable to reach America. The slowdown of the flow of goods not only affects the companies’ abilities to export but also impacts the investors’ trust in their shares. Interruptions in Chinese supply chains are instigating a loss of confidence in the market overall, creating significant turmoil worldwide.

Investors’ fears about their stocks are not the only reasons for the market’s plunge. In early March, Saudi Arabia started a price war with Russia by cutting their export oil prices. These cuts led the global oil benchmark to drop by 25%. The production, trade, and wealth from oil not only affects individual consumers around the world—for countries such as Venezuela and Iran, whose economies are oil-based, a sudden drop of prices is devastating, and the economies of these nations are already failing. Oil is one of the most important global resources today, and the sudden cut in prices resulted in oil market drops up to 6% in various countries. With the oil market dropping continuously as the feud between Saudi Arabia and Russia continues, oil corporations and consumers alike are facing an even larger financial loss. Mr. Brandon Kells, a CRLS economics teacher, told the Register Forum, “The reason why price wars in oil have such significance is that the cost of production in the US to get the oil out [of] the ground is more expensive than Saudi [Arabia]. Once the price of oil dips, it’s no longer profitable for American oil producers.”

The stock market is unpredictable and constantly fluctuating. Its current drop could be turned around with the end of the price war or increased investment in health-related products, the latter of which is likely inevitable as people around the world scramble to fight the pandemic. If the stock market is unable to bounce back, nations worldwide will not only experience a devastating health crisis but an economic one, too.