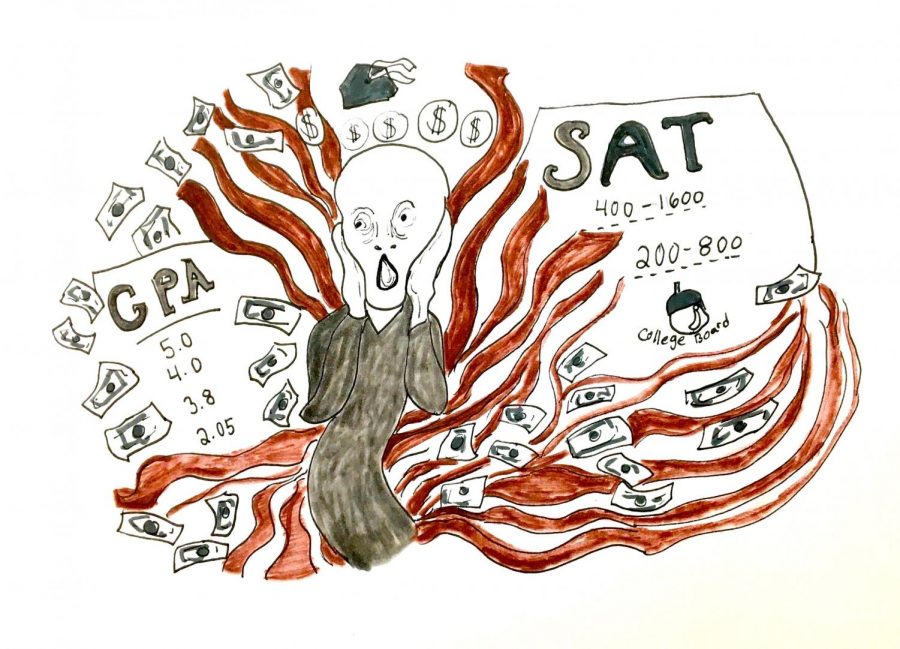

The Hidden Cost of College: Test and Application Fees

In Addition to Skyrocketing Tuition, It Can Cost Thousands to Even Apply to College

March 28, 2019

It’s become accepted that higher education comes at a cost—in nearly all instances, attending college brings with it hefty tuition fees in the hundreds of thousands. Ironically, the ability to even apply to college is hindered with hidden fees and expenses that are less frequently discussed. Tuition costs are often accused of limiting the enrollment of financially disadvantaged students, but the cost to apply can result in a litany of expenses that families struggle to pay.

One of the first costs for many students is the price of standardized tests, such as the ACT or SAT, which are required by most colleges. Students often take these tests multiple times and, combined with “score send” fees, these expenses can quickly climb to the hundreds. Taking the SAT with essay costs $64.50; combine this with the cost of score sends to eight schools ($11.25 apiece), and the price of the entire testing experience has climbed to $238.50. But it doesn’t stop there. Test prep books are offered by the College Board, but these cost $28.99, and students must pay $31.50 to review their previous answers to improve their performance. Aside from the fact that this $363 total can already be too high for many students, some students will take the SAT more frequently, send scores to more schools, or pay for tutoring services.

For students to demonstrate academic prowess to colleges, AP exams and SAT Subject Tests are often a necessity. Though optional, they are highly encouraged by many schools, and each AP exam costs $94. Similarly, Subject Tests come with a base price of $26, in addition to the $22 fee for taking each test. Add these exams to the bill, and testing alone has already cost $1,311. Additionally, application fees for most schools can range anywhere from $25 to $90—multiply this for eight schools, and the bill could reach $700 or more.

These fees are hardly inconsequential, and they must be paid over a short timeframe, with no guarantee that the expense will pay off. Fee waivers are available to some, but families who fail to qualify for reduced pricing can still be impacted by pre-college costs; a household of four making $47,000 annually would fail to qualify for a fee waiver, but could still struggle to pay full price. So, why are these fees so high? The College Board, a non-profit organization with an annual revenue of over $1.1 billion, pays its executives $750,000, yet still has millions left over. Considering that the College Board has cornered the market on testing, it is reasonable that they should be subjected to regulations that allow their services to be more accessible, in light of other, unavoidable expenses that result from the pursuit of higher education; students should be investing in their education, not struggling to afford the opportunities of wealthier students.

Attending college is meant to set up a student for a successful life, but when the mere cost of applying is added onto the already exorbitant prices of tuition, we must reconsider whether the high cost of pre-college expenses can be justified.

This piece also appears in our March 2019 print edition.