The Student Debt Crisis is Real, But Not Unsolvable

June 28, 2022

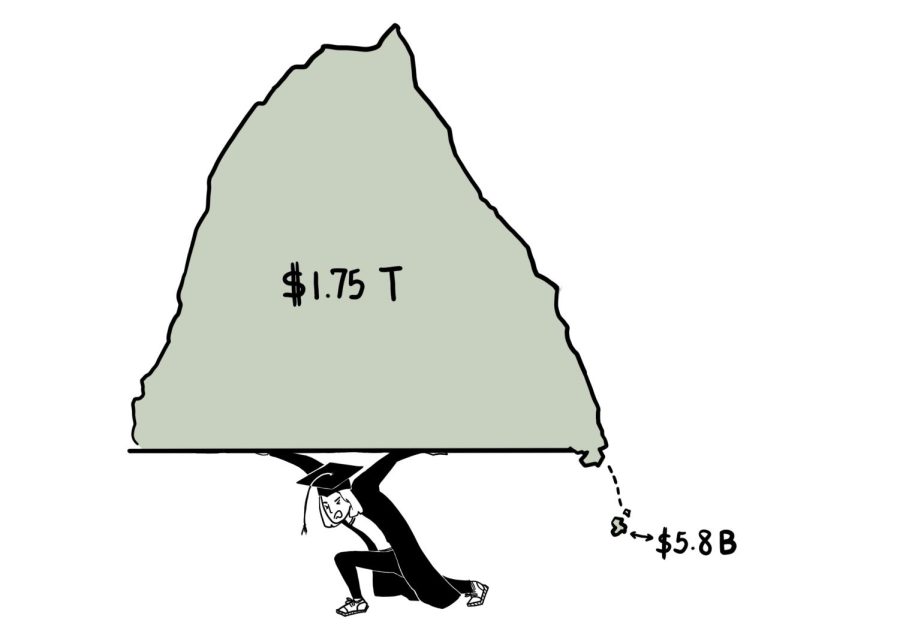

It’s not a secret that America has a student debt crisis. Student loan debt across the United States totals to nearly 1.75 trillion dollars, and is spread across some 46 million Americans. Think about it like this: Elon Musk, currently the world’s richest person, has a net worth of a little more than 220 billion dollars. It would take almost eight Elon Musks to pay off all of America’s student debt. Think, for a moment, how much of a burden that is for everyday people—especially considering that as of March 2022, 64% of Americans live paycheck to paycheck. \

Before we move on, I realize it’s important to consider that those 46 million Americans with student debt may not (for the most part) fall under the same demographics as those 64% of Americans living paycheck to paycheck. But according to a small study conducted by Intelligent, nearly half of the 1,000 Americans with a “university or post-graduate degree” surveyed said they lived paycheck to paycheck. According to this same study, “1 in 4 are making under $30K/year, while 14% earn below the [federal] poverty threshold.”

Okay, so we’ve identified the problem. Now what’s the answer? Obviously the solution has to fall to the government, from the fact that it would take eight Elon Musks to pay off America’s student debt. Thankfully, the Biden administration has been taking steps in the right direction. On June 1st, Biden announced that $5.8 billion in loans from the for-profit college chain Corinthian Colleges would be canceled, freeing 560,000 students of their debt. (According to The Best Schools, “For-profit colleges spend an average of just 29 cents on student instruction for every dollar in tuition.”) But in my mind, the solution is canceling all student loan debt. Yes, $1.75 trillion is a lot of money, but according to the Center for Law and Social Policy, “Research has shown that [student debt] cancellation would boost GDP by billions of dollars and add up to 1.5 million new jobs, reducing the unemployment rate.” This is a huge benefit on its own, but it’s also important to consider equity when we look at solutions.

According to the New York Times, some argue against canceling student debt, for the reason that it “boosts the balance sheets of people who attended college while doing nothing for people who did not attend college, even though the latter is … worse off in many respects.” Although I agree with this statement in part, I also believe that good should not be halted for the cause of perfectionism. No, it isn’t fair that college-educated people should get this kind of help instead of those with just high school diplomas, but at the same time, isn’t some progress better than none? Besides, canceling student loan debt doesn’t need to happen in a vacuum, without considering other ways we can help historically impoverished communities. Giving one group of people a push forward doesn’t mean holding others back, and the pandemic has made the importance of government assistance even clearer during times of hardship.

This piece also appears in our June 2022 print edition.